Liquidity Services

Built Flexibly

For Your Profit

Access institutional liquidity on terms that fit your business.

Check Our Product

Pick Your Solution

Learn about our solutions backed by technology and market expertise.

Prop Firms

Prop

Liquidity

A new model for hedging the

funded phase that removes

100% of the risk

FX Brokers

Forex & CFD Liquidity

Ultra-low latency execution on

430+ instruments

with spreads from 0.1 pips

Why Choose Us

10 Years

of Experience

Prime

of Prime

Connected to FX prime brokers and top-tier LPs

150+ Brokers Globally

Powering smooth trading experiences for clients worldwide

Regulated

& Trusted

Licensed and compliant in Seychelles, Vanuatu, and South Africa

Expect more.

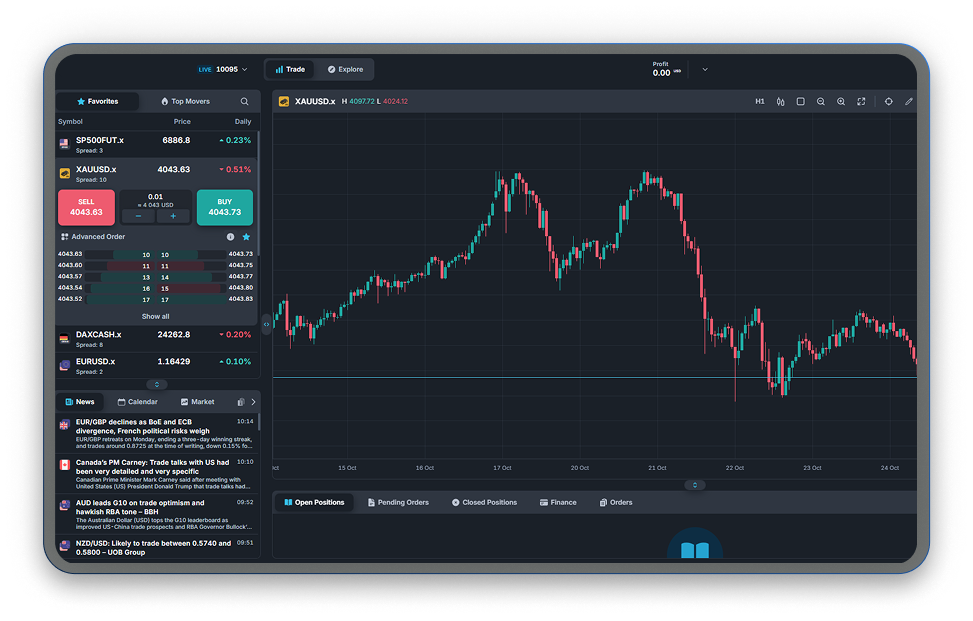

Powerful Technology

Our platform is built on Match-Trader Pro, with a proprietary matching engine, FIX connectivity, and analytics.

As Match-Trade Technologies’ liquidity partner, we bring you institutional-grade technology.

Vast Ecosystem

The liquidity platform comes ready to work with the systems you use

– leading distribution systems, CRMs, and all the apps you need.

Abuse Protection System

Built-in protection. HawkEye, a risk management system, spots and handles abusive trading.

You send the flow, we deal with the threats.

Trading Flow

Manual Trading

Algorithmic HFT

High Volume Tickets

Abusive Trading

Input Flow

HawkEye RMS

Real-Time Analysis

Pattern Recognition

Instant Classification

Smart Routing Decision

Allocation

Liquidity Pools

Standard Pool

Dynamic Pool

External Liquidity Pool

Toxic Pool

Move fast.

Time is money.

We Move Fast

Total Time to Launch

Average of 5 days

From inquiry to live trading in 5 days. Start saving this week, not next month.

Day 1

Day 5

Contact

Inquiry

Quick call

Approval

Same day

Onboard

Documentation

Account setup

Credentials

2-day process

Setup & Test

Bridge setup

Integration

Testing

Go-live

Live Trading

Full access

Start trading

24/7 support

Volume growth

Bridge Included

At no additional cost.

FX-EDGE clients get free access to Match-Trade’s

MT4/MT5 Bridge for both A-Book and B-Book.

LP2

EUR/USD

1.17120/1.17122

LP1

EUR/USD

1.17120/1.17121

LP3

EUR/USD

1.17121/1.17123

LP4

EUR/USD

1.17121/1.17122

Bridge

Best BID/ASK

1.17120/1.17121

Profit More

Compare our rates

Reach out and see how your costs stack up against the value you get.